Portfolio summary

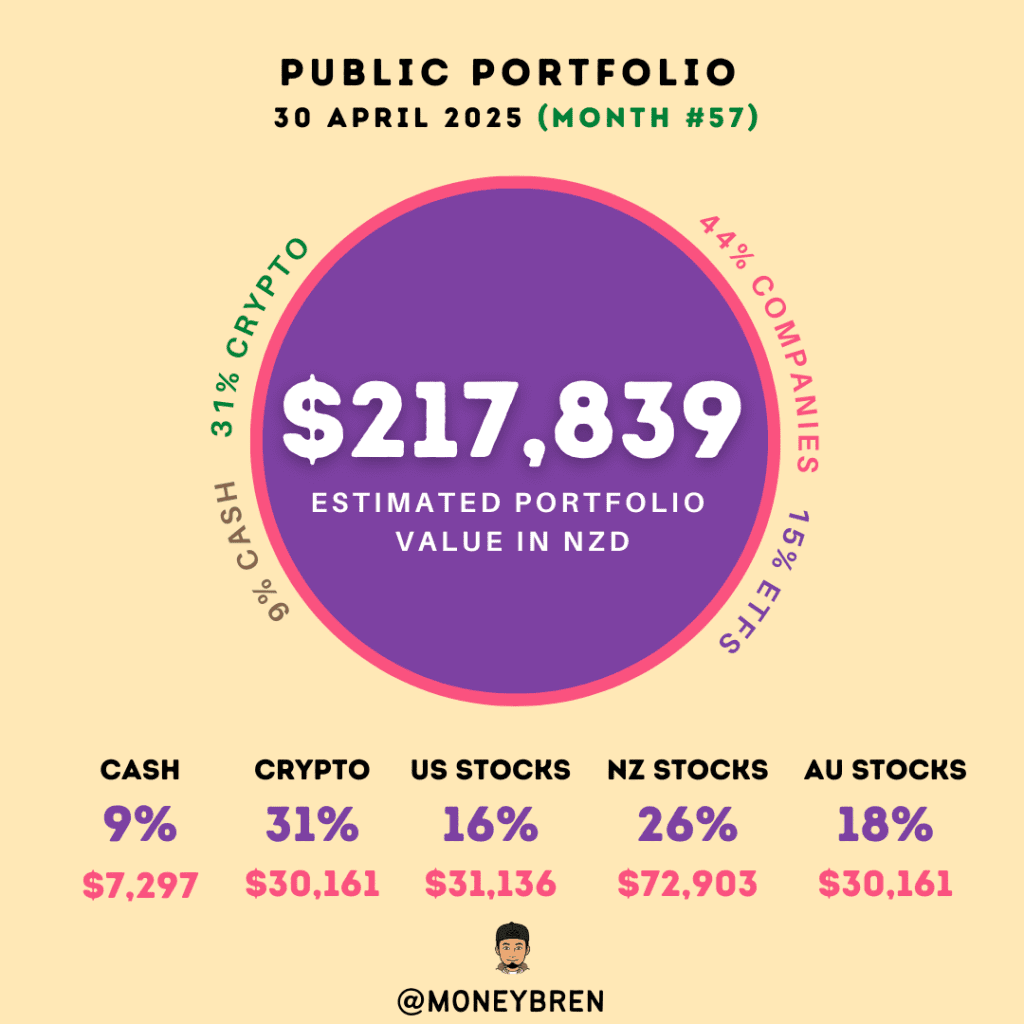

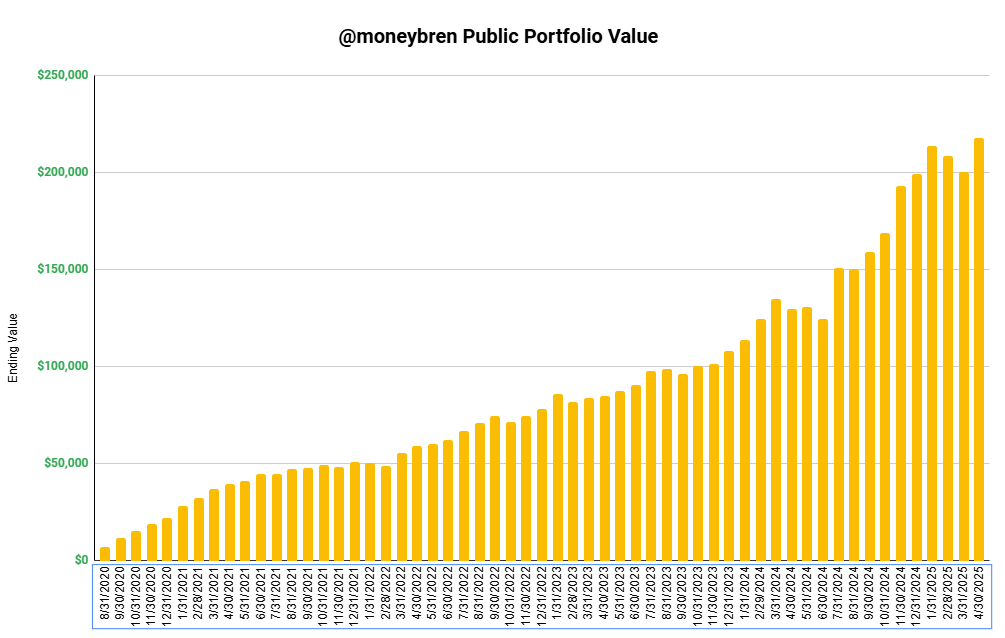

- Current portfolio value is $217,839 after 57 months.

- The change in portfolio value for the month was +8.9% (March $200,045).

- The investment return for the month was 7.85% and is currently 0.73% for the year.

(The change in portfolio value and investment return are different, because one takes into account new cash added to the portfolio and one doesn’t).

This portfolio is made up of:

💥 BOOM weekly savings: $6,399

⠀⠀

🚮 Decluttering: $11,686 (get started here!)

⠀⠀

💸 Matched betting: $47,847 (get started here!)

⠀⠀

📦 Flipping: $2,676 (get started here!)

⠀⠀

📝 Surveys: $150 (get started here!)

⠀⠀

🖥️ Simple Courses sales: $12,094 (view all my courses here!)

🏋️♀️ 1-on-1 coaching: $390

⠀⠀

🎉 Sharesies bonuses: $150⠀⠀

⠀⠀

🧧Leftovers from Chinese New Year Instagram giveaway because people didn’t want free money: $90⠀⠀

🎁Leftovers from 500 follower Instagram giveaway because people didn’t want free money: $300

⠀⠀

💰 Personal dividends: $3,541

🖱️ Niche Site A (Home Remedies): $11,810 (get started here!)

⠀

🖱️ Niche Site B (Fitness): $4,432 (SITE SOLD!)

⠀

🖱️ Niche Site C (Superfoods): $7,285

🖱️ moneybren.com (affiliate commissions): $33,949

💵 Interest: $567

⠀

💹 Sharemarket gainz: $37,832 (get started here!)

💹 Crypto gainz: $37,431 (get started here!)

Millennium Copthorne Hotels

The major change to the portfolio this month was the takeover of Millennium Copthorne Hotels.

This has been a major position in the public portfolio since almost the beginning, based on a very simple thesis that it was trading under book value.

The company had a net property portfolio of close to a billion dollars while the company traded around $300m.

For years it looked like we’d never extract the value but MCK finally received a takeover bid in January for $2.25 per share.

That offer was a lowball and rejected by the directors and all major shareholders.

An improved offer of $2.80 was given this month and I voted yes.

Our net cost per share was around $2.00, so we made about 40% over 4 years, which isn’t terrible but not great either.

However it was an extremely low risk bet, so I’m happy with the outcome.

We now have an additional $19,000 in cash which I have to deploy elsewhere – am looking!

Deckers

One of the new positions in the portfolio is Deckers Brands – a footwear company based in USA.

I like Deckers because I use their product (the Hoka brand) and I’ve been watching them for some time (I actually talked about them in my course Simple Stocks).

Deckers is down around 50% from its peak and now at a price I’m looking to enter.

I started opening a position under $100 at around $97, and then unfortunately it shot back up to $117 today – outside of my buy range.

I’m looking to keep building if the price comes back down.

I wrote a full breakdown on Deckers here.

Capral

Capral is one of the best value stocks I’ve seen probably since this portfolio started.

They’re an aluminium processing company out of Australia trading at just 1x EBITDA and about 4x free cash flows.

They have almost half their market cap in cash, and are aggressively buying back stock.

I opened a position around $9.20 which was right in my buy range, but they’ve since shot up to over $10.

I’m not sure if I’ll get the chance to keep building, but I’m keeping an eye on it. I really like this one.

I wrote a full breakdown of Capral here.

You can view all previous portfolio updates here.

Everything above can be done by you!

Want to get started and not sure where to start?

Wealth Builder is everything you need to start transforming your finances today. Get it here.