Portfolio summary

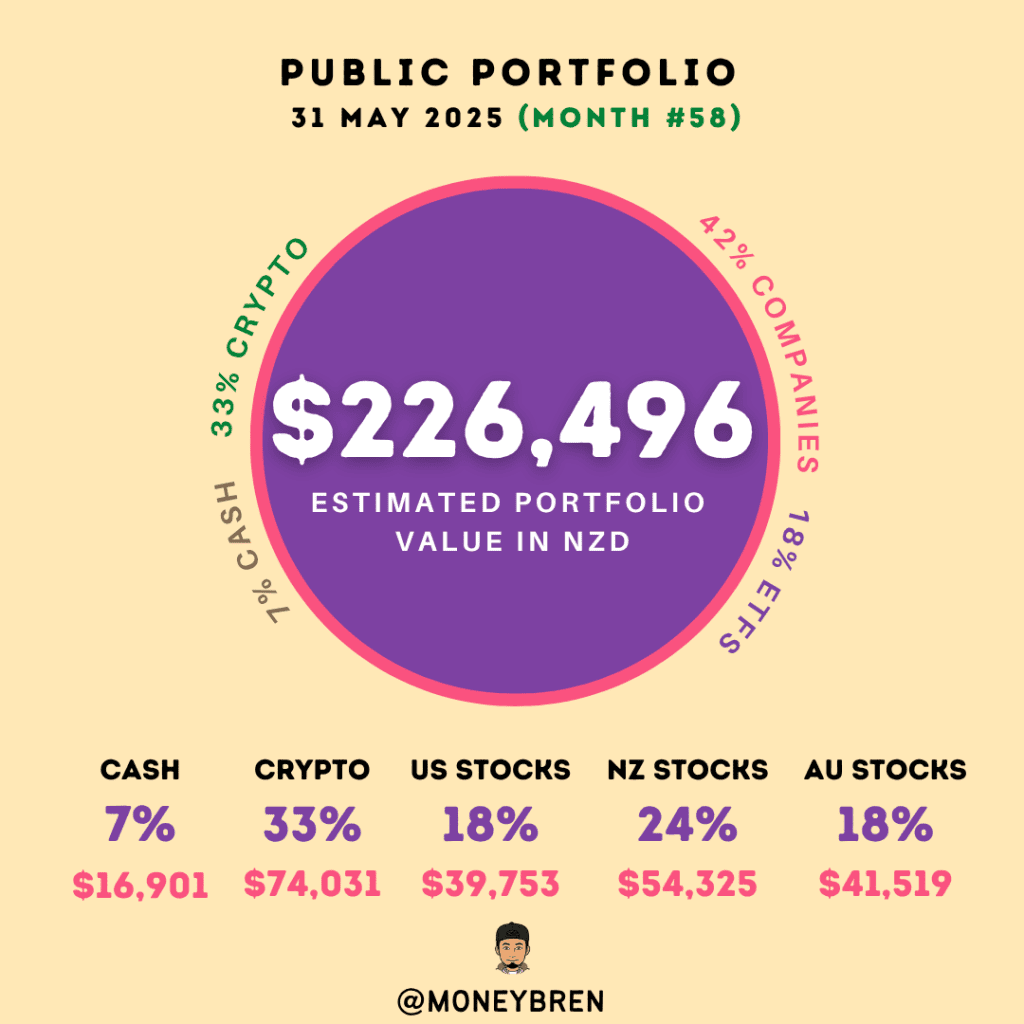

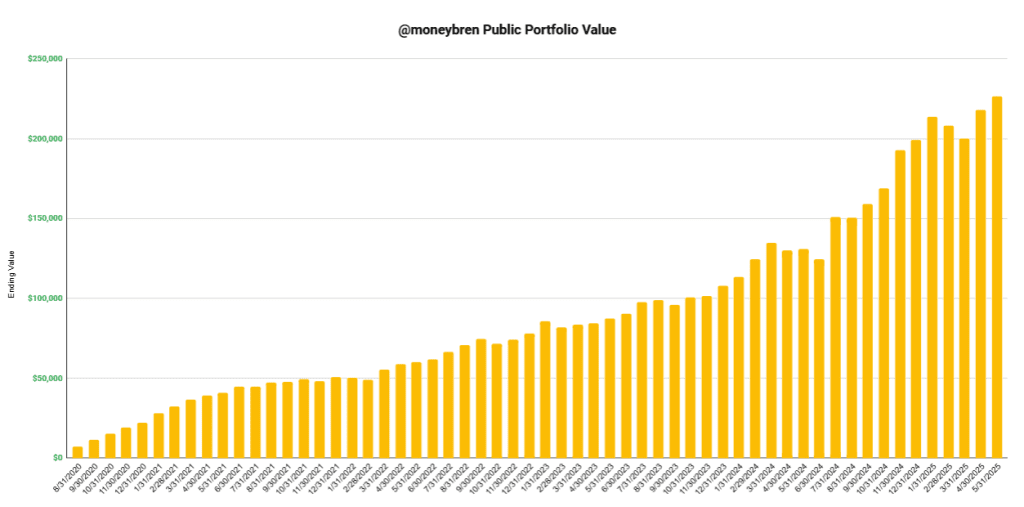

- Current portfolio value is $226,496 after 58 months.

- The change in portfolio value for the month was +4.0% (March $217,839).

- The investment return for the month was 2.99% and is currently 3.71% for the year.

(The change in portfolio value and investment return are different, because one takes into account new cash added to the portfolio and one doesn’t).

This portfolio is made up of:

💥 BOOM weekly savings: $6,399

⠀⠀

🚮 Decluttering: $11,686 (get started here!)

⠀⠀

💸 Matched betting: $47,847 (get started here!)

⠀⠀

📦 Flipping: $2,676 (get started here!)

⠀⠀

📝 Surveys: $150 (get started here!)

⠀⠀

🖥️ Simple Courses sales: $12,094 (view all my courses here!)

🏋️♀️ 1-on-1 coaching: $390

⠀⠀

🎉 Sharesies bonuses: $150⠀⠀

⠀⠀

🧧Leftovers from Chinese New Year Instagram giveaway because people didn’t want free money: $90⠀⠀

🎁Leftovers from 500 follower Instagram giveaway because people didn’t want free money: $300

⠀⠀

💰 Personal dividends: $3,541

🖱️ Niche Site A (Home Remedies): $11,997(get started here!)

⠀

🖱️ Niche Site B (Fitness): $4,432 (SITE SOLD!)

⠀

🖱️ Niche Site C (Superfoods): $7,285

🖱️ moneybren.com (affiliate commissions): $35,812

💵 Interest: $567

⠀

💹 Sharemarket gainz: $37,832 (get started here!)

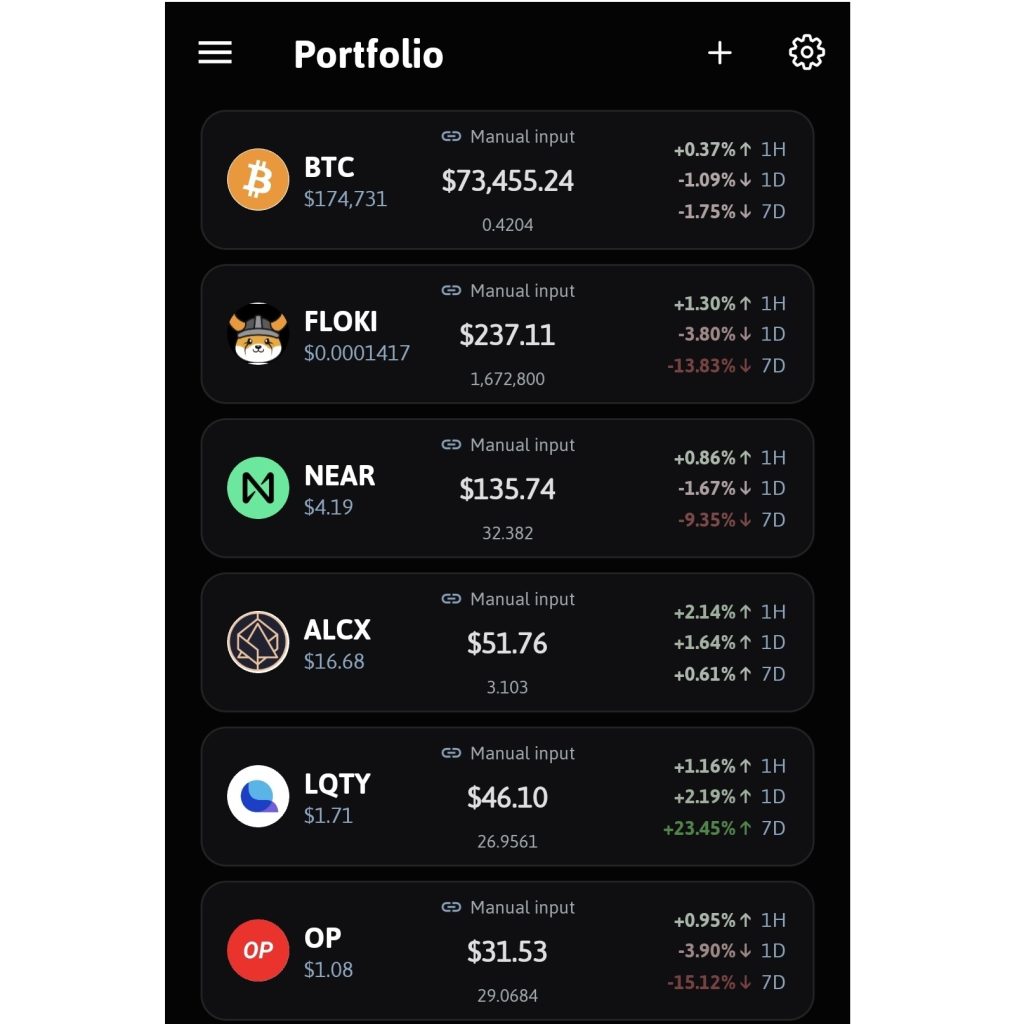

💹 Crypto gainz: $37,431 (get started here!)

Briscoes

The only significant change in the portfolio is Briscoes.

I started selling down the Briscoes position this month. In the end we’ll probably make about 8% on it.

The reason is because their balance is going through a period of transformation and will look quite different over the next couple of years.

The thing that made Briscoes investable was they had a fortress of a balance sheet with about $175 million in cash. Even in a deep recession they would have been perfectly fine.

Briscoes has started building a warehouse and distribution centre in South Auckland that is expected to cost about $150 million which will burn up almost all of their cash reserves.

The company is still free-cash-flow positive and will likely make around $30-40 million a year in free cash flow, but at a market cap of $1.1b it’s starting to look expensive.

Generally, capital expenditure that expands the profit-earning capacity of the business is a good thing – and it will likely turn out good for Briscoes in this instance too. However I’m not convinced the new distribution centre is going to catalyse an increase in profits big enough to recoup that $150 million in a hurry.

To crunch some quick numbers, when I bought it the company was trading at ~900m with 175m in cash for an EV of 725, free cash flow was ~90m, giving you a multiple of 8x. Pretty good deal for an 8% dividend payer of Briscoes calibre.

Since putting their cash into the new warehouse, they’re trading at 1.1b with 140m in cash for an EV of 960m, free cash flow is now 33m for a multiple of 29x.

Big difference!

Even Google is trading cheaper than that.

I still think Briscoes is a great company with one of the best CEOs in New Zealand, but I think it will be a challenge for them to grow into their new 150m investment in a hurry. Am actively closing the position, but will look to re-enter somewhere down the line if things look good.

You can view all previous portfolio updates here.

Everything above can be done by you!

Want to get started and not sure where to start?

Wealth Builder is everything you need to start transforming your finances today. Get it here.