If you follow 13Fs you will see Warren Buffett is betting big on oil, with multi billion dollar bets on Chevron and Oxy this quarter.

I think he’s right. I think oil is going to $200 a barrel. Probably higher.

There is currently an attack on oil. Everywhere you look, oil is bad. Governments are stifling both supply and production. Permits are harder to get, you have the Russia situation, and gas prices are at all-time highs and they seem very happy about it.

“Just buy an electric car” they say.

Your government do not want you to use oil.

Here’s the problem. The world runs on oil. Don’t get me wrong I think green energy is great, but the world is not set up to run on green energy in 2022. If we want to get the world on green energy, we first need to develop green infrastructure.

How many people do you know who drive an electric car? How many electric car charging stations do you see each day? How many electric cars can drive more than a few hundred kilometres on a single charge?

The real inconvenient truth is our world needs carbon energy to operate. We have been building carbon energy infrastructure for the last 100 years, hence we need carbon energy to live. Green energy does not work (yet). Windmills are great but it is not always windy. Solar is great but it is not always sunny. Hydro is great but it is not always rainy. The truth is oil and coal is both the cheapest and most reliable energy we have.

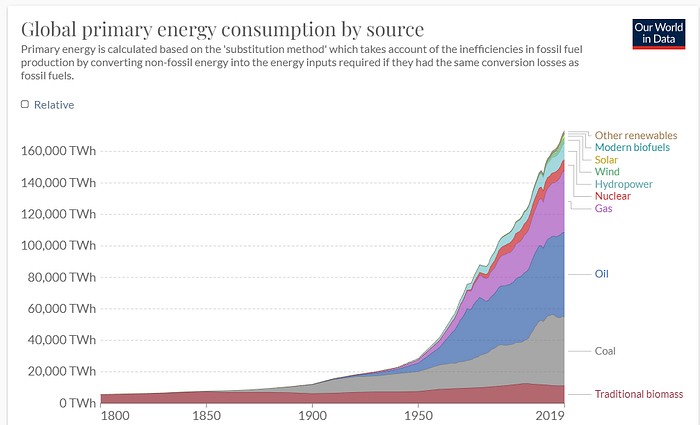

Think about that — reliable energy. This is important because the world needs energy. Even to charge your Tesla, some (or all) of that energy likely comes from coal or oil. Right now, more than 80% of global energy comes from coal, oil and gas. Renewables make up a tiny minority, mostly in very wealthy countries. It doesn’t even come close to fulfilling the world’s energy needs, and won’t for many years.

What’s more, energy demand is not falling. It is rising. People want things, they want to build things, and every single thing in the world needs energy. How often do you charge your phone? How often do you leave your home to drive somewhere? How often do you cook food? How often do you have a hot shower? All that requires energy, and since renewables are unable to supply the majority of it for the world, it must come from coal or oil.

Think about when you build a house.

What do you think powers the machines that cut down the trees and process them into timber?

What do you think powers the shipping tankers that transport it into the country?

What do you think powers the trucks that transport it to your building site?

Oil.

So as long as you like living in houses and using kitchen appliances and travelling on airplanes, until they manage to build a shipping tanker that runs on solar panels and can travel across the Atlantic using only the sun, we will continue to need oil.

Here’s a prediction: Sooner or later, the squeeze in oil supply is going to skyrocket demand (it already is), and that cannot go on for too long. Spend five minutes during rush hour in any African or Asian metropolis and see how essential oil is to the survival of billions of human beings. Anybody who has travelled for five minutes in Africa, India, China, or anywhere in the developing world can tell you the dire consequences if oil is not in easy supply. Cut the supply of oil and you will have widespread starvation, disease and anarchy overnight. Cheap energy is not only how developing countries develop, but also keep their people alive.

So the anti-oil brigade needs to choose; do you want clean air, or freezing and starving children? Because I’m not exaggerating when I say it is literally one or the other. Maybe in 2050 you can have both, but not in 2022.

Again, green energy is great, but until you can feed 8 billion mouths on windmills and solar panels, we need dirty energy too, and will for a lot longer.

Which brings me back to Buffett. Why is he betting on oil? Because oil is as essential as oxygen, and the squeeze in supply is going to pump this price to record levels. And a beneficiary of that will also be oil’s dirty cousin. Because when oil pumps to record levels and people can’t afford it, where will they turn?

The next cheapest energy. Coal.

Long story short: Bullish oil. Bullish coal.

Not financial advice. I am not your financial advisor.